[vc_row][vc_column][vc_column_text]Cinchy recently closed a $10 million Series A funding round, and the process of getting it done was made infinitely more complicated by the pandemic.

Even at the best of times, getting all of the stars aligned is a daunting, time-bending process. When the world goes virtual, even seemingly small steps become significant hurdles. Fortunately, our team — and our investors — were able to get through the logistical issues and get to the finish line.

Online Speed Dating: The New Investing

For a Series A funding round, you would typically spend a lot of in-person time with your lead investors to get to know each other and make sure it’s a good fit. As they say, it’s kind of like you’re getting married. There is a meeting, an in-person date, and then the relationship progresses from there. In our case, as a maturing company paired up with a lead investor, there was that initial presentation, and then everything else was virtual. We were “married” virtually.

The lockdown also affected the way we prepared for this round. No one really knows what the future is going to be, so the level of diligence was exponentially heightened as a result of that.

There were about three to five meetings with our VP specifically, and approximately 100 artifacts that needed to be gathered. The level of diligence required was very high relative to what we did in our seed round. Part of that is because a Series A is different from a Series C.

The other part of that could be the fact that investors are more cautious than they would have been before, because there’s so much volatility and unknowns. This was especially true when we were in the thick of the pandemic. Investors are also looking for technologies that are bulletproof, which puts a new lens on how we approached this round.

[/vc_column_text][vc_row_inner][vc_column_inner][featured_posts title=”Read More” category=”finance” number=”4″][vc_column_text]

Back To The Future

It’s as if every business in the world had to leap 10 years into the future where everything needs to be digital — but the tech isn’t there yet. So, you must imagine what the applicability of your technology is 10 years from now. This would have been the perspective of investors after the start of the pandemic.

We have been forced to ask questions like, does this make sense in the new world and not in the old world? And in order to do that, you need to predict what that new world will look like. With the idea that things need to be digital now, there will be more remote interactions and more virtual experiences, these issues were important before, but they’re exponentially more important now.

In every meeting, we talked about how strange the digital navigation experience really is. But at the end of it, we had virtual beers with the investor, and we celebrated with our staff through video chats.

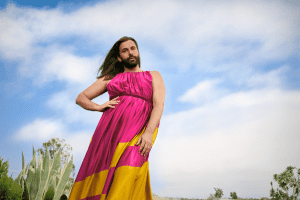

None of us had ever closed any series within days before. That is the benefit of forced re-evaluation of familiar processes in a pandemic. And possibly and indication of the way forward.[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_separator][vc_row_inner][vc_column_inner width=”1/2″][vc_single_image image=”18387″ img_size=”medium”][/vc_column_inner][vc_column_inner width=”1/2″][vc_column_text]Dan DeMers is the CEO and co-founder of Cinchy, the global leader in enterprise Data Fabric and Data Collaboration technology. Previously, he spent over a decade as an IT executive with leading global financial institutions where he was responsible for multi-million dollar technology investments. Dan talks regularly at major technology conferences and has recently appeared at TechCrunch Disrupt, Strata Data NYC, and Finovate NYC.[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]