[vc_row][vc_column][vc_column_text]Marble Financial wants to help you gain control over your personal finances.

The company, which began as a way to help Canadians struggling after an insolvency event, is continuing towards its goal to improve financial literacy and education with the launch of MyMarble. The AI-driven platform helps consumers manage their money, create a budget and improve their credit scores in a simple and easy to use way.

“COVID-19 has brought a significant amount of pain to consumers,” said CEO of Marble Financial, Karim Nanji. “It also brought an awakening to the average consumer about the importance of their personal finances, which affects budgeting and prospective credit. The users on our platform are starting to realize the value of engaging with their personal finance.”

He adds that while many companies offered a way to see one’s credit score, there was a gap in the market for offering consumers a tangible way to improve it. By using real time data from a user’s bank history, MyMarble can do just that.

In addition to MyMarble, the company’s Fast Track program helps those with existing consumer proposals, while Maestro offers Canadians a free financial literacy education.

“Marble is empowering Canadians towards financial inclusion and a positive financial future, using our proprietary and innovative technology and credit solutions,” said Nanji. “Ultimately, Marble aims to put the power back into the hands of the consumer and give them control of their financial future.”

As the COVID-19 pandemic affects the financial situations of Canadians from coast to coast, staying on top of personal finances is more important than ever. For this week’s Start-Up Spotlight, Bay Street Bull spoke with Karim Nanji about how Marble Financial makes managing your finances attainable and how their latest offering, MyMarble, fills a gap in the market.[/vc_column_text][vc_text_separator title=”Q&A” color=”custom” style=”dotted” border_width=”4″ accent_color=”#1ba2b7″][vc_column_text]Can you tell me about the origin of Marble Financial?

Marble started in 2016. The original founder of the company was focused on helping individuals that had come out of an insolvency event. To give you some background on that, insolvencies on the consumer side (on the personal side) have been increasing considerably over the last few decades. There’s two types of personal insolvency: one is the state of bankruptcy where your assets are liquidated and whatever is left pays off the creditors. There’s another government sponsored program, called the consumer proposal, which started overtaking personal bankruptcy. Typically what happens to this situation is an individual who is facing an insolvency event, is working with a trustee and the trustee works with the creditors and the individual settles their debt typically on 35 cents on the dollar. Then, the consumer pays off the trustee over an average of 60 months.

So in 2016, the founder launched a program to deal with consumer proposal. Since I joined in March of 2019, we’ve called that program Fast Track. It’s a product that caters to the individuals who have poor credit rating that makes it difficult for them to access traditional sources of financing: banks, credit unions and trust companies, because of this insolvency. Fast Track focuses specifically on the customer who has completed the government regulated process and we help them rebuild their credit, by taking over the obligation to the trustee and the consumer then pays us through the program. We report to the credit reporting agencies and that’s where the credit rebuilding starts. So, instead of being in the program for eight years before the negative marks on their credit are removed, they start the credit building as soon as they start with Marble. You take the eight years down to four years and the credit rebuilding is happening as they’re making their payments.

That definitely speeds up the process for a lot of people and helps them get back on their feet a little quicker.

One of the things that happens with these individuals is that once they’ve settled their obligations through the legal process, to a trustee and the superintendent of bankruptcy, if they don’t have credit, it’s very difficult for them to be able to survive. They’ve settled their debts and they come out into this brave new world and realize that they can’t get credit from anybody because most lenders, if not, all of them, will decline an individual for an unsecured loan, as long as there’s an active insolvency on their credit report. So that’s where the Fast Track program is very beneficial.

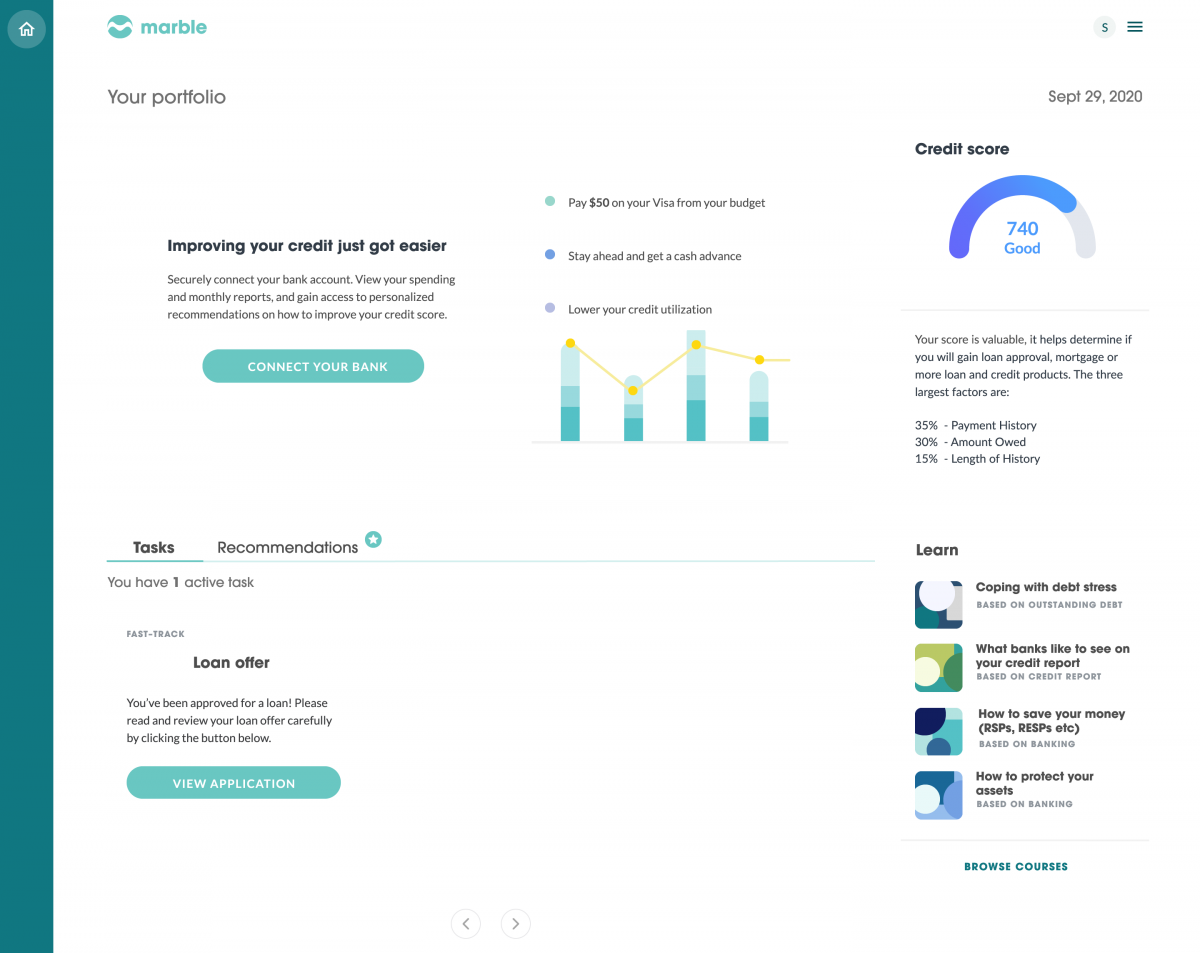

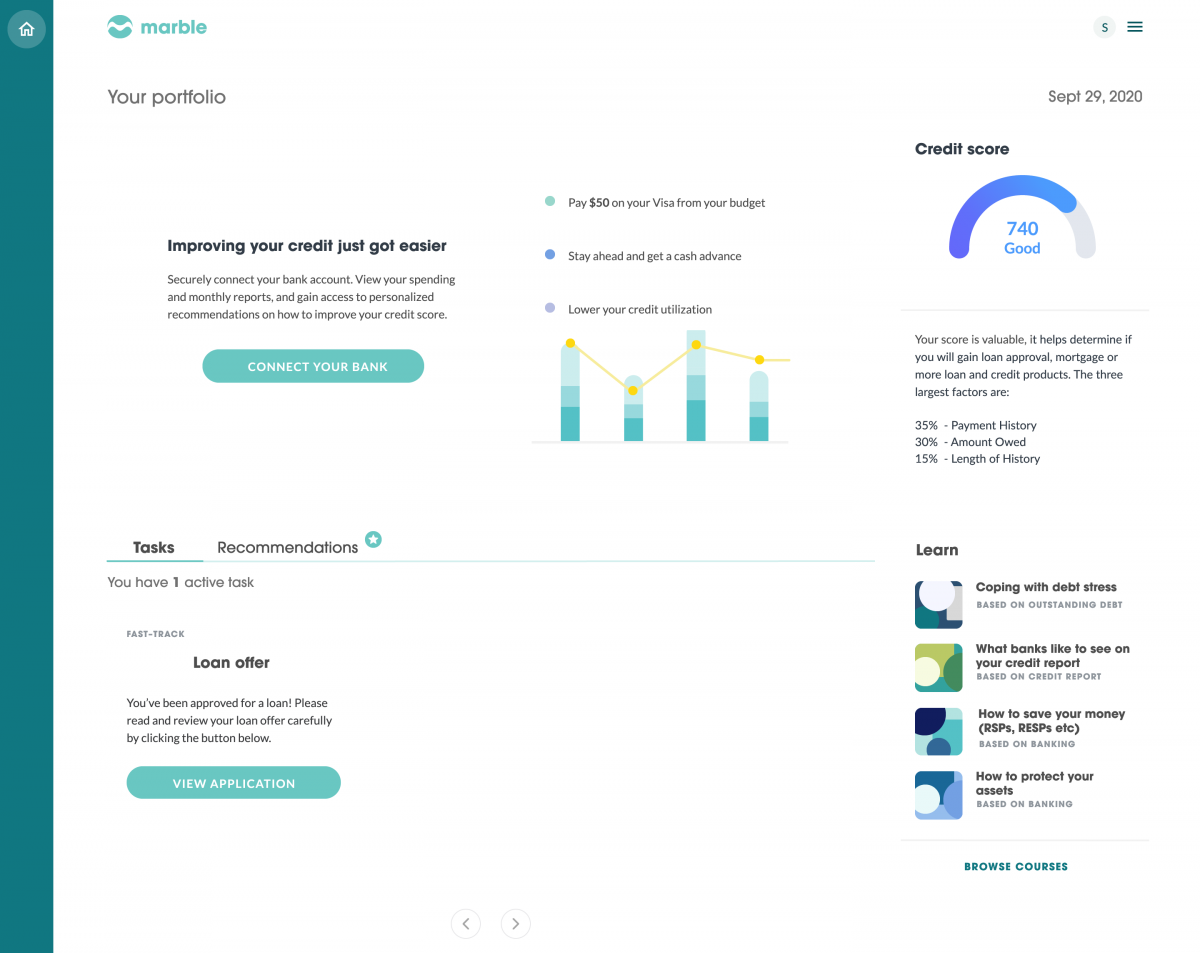

You guys recently launched MyMarble, which is more of a personalized AI data approach to staying on top of your finances. How exactly does that work?

MyMarble is a proprietary stats-based, artificial intelligence, personal finance and credit wellness platform that also focuses on financial literacy. It’s a subscription software, that provides users with more granular solutions, in the areas of budgeting, cashflow, analysis, budget, and credit insights and recommendations to help them get to their targets. Or if they’ve got a certain amount of disposable income, where’s the right place to apply that money to get the biggest bang for the buck? So, the insights they get with respect to the credit report focuses exactly on what they need to do to be able to get a more optimized credit score.

There’s a lot of companies out there that provide free credit reports; we found that there’s a void in the market with telling individuals exactly what they need to do to improve it. On top of that, financial literacy and education is one of MyMarble’s main goals: to educate everybody on things that impact their financial wellness. Then also teaching good financial habits and giving specific insights.

All of this is data driven. It’s based on a real credit report and the actual standing of their bank account. We package it and provide it to a consumer in a way that’s digestible and gives them insights on exactly how they’re currently managing their finances.

And with your experience in the financial world, would you say there’s a common misconception or a mishandling of personal finances that you kind of see time and time again and where people go wrong?

Ultimately, poor credit is a function of not being able to manage your obligations. To give you some backdrop here—and these are all pre COVID-19 stats—almost half of Canadians are living paycheque to paycheque. At the time, 47 percent of Canadians who responded to a survey done by an insolvency firm said that they don’t even believe that they can cover their expenses for the next 12 months without increasing debt. More than half of Canadians said that they’re increasingly concerned about their ability to pay their debts because their disposable income has shrunk. Statistics Canada, on similar backdrops, said for every $1 of disposable income, Canadians are carrying on average about $1.70 of debt. So, we are very much a credit economy.

Canadians need access to credit in order to manage their daily life and expenses, whether it’s for long term goals or an emergency. However, many Canadians are marginalized from mainstream banking and financial services because the credit system is predicated on having good credit. So, when these individuals have a life event such as divorce, drama, sickness, death in the family, they can’t manage their debt and they fall into a spiral. And ultimately, one of the things that we see with everybody, is this all stems from poor management of their money. People will say, “I don’t have money,” but imagine if I could tell you, you just spent $400 on Starbucks this month.

So, we provide them the budget insights. Our software tells them exactly which accounts, when to pay, and how to improve their credit score. A better credit score means more banks or financial institutions are willing to talk to you, which can be the difference between an approval and a decline.

Was it a challenge in bringing MyMarble to life?

The company went IPO in March of 2019. At that point in time, Fast Track was the only product the company was offering. What we found, and we did a strategic pivot, is it’s a catch-22: In order to build credit, you need access to credit. It’s very akin to going out for your first job interview and the employer says, “Do you have experience?” And you say, “No.” You need the job to get the experience—a similar thing happens with credit. It’s very difficult to build positive credit without somebody willing to grant it to you. So, we pivoted to software and we wanted to provide education on the financial literacy side, as well as provide technology to people that they can engage with over time.

The challenge was making that strategic pivot and then accessing consumer data. Data from the consumer comes from their bank accounts, so, we had to find the right technology partner, integrate with them, and do the same with the credit reporting side. The challenge now is mostly around educating the consumer, showing them the value in our product.

Can you explain the story behind the name Marble?

When we were all kids, we played marbles. The game of marbles is based on hitting targets, hitting goals. The concept around Marble Financial is to be able to achieve those same goals with respect to your personal finance, whether it’s budgeting or savings or paying off debt. So, ultimately the goal with Marble Financial is around gamification: hitting your targets and hitting your goals, with respect to the same type of analogy with the game of marbles.

If you were to sum up Marble Financial’s overall mission, what would you say that is?

Marble is empowering Canadians towards financial inclusion and a positive financial future, using our proprietary and innovative technology and credit solutions. Ultimately, Marble aims to put the power back into the hands of the consumer and give them control of their financial future.

COVID-19 has brought a significant amount of pain to consumers. It also brought an awakening to the average consumer about the importance of their personal finances, which affects budgeting and prospective credit. The users on our platform are starting to realize the value of engaging with their personal finance. We’re talking to everyday people that may not be as sophisticated in the financial or the FinTech world. There’s things that the average person just doesn’t know. By providing the data to consumers in a positive user experience, we’ve had very good reviews about how the software is helping them month to month.

The real value comes over time as the consumer is achieving their goals for their financial future. We have individuals who have a hard time doing a budget. There’s other individuals that sign up and see a massive credit increase in a month or two. Everybody gets different results based on their unique situation. We look at ultimately getting Marble in the hands of every Canadian consumer—not just individuals who are marginalized from the mainstream financial economy—because Marble provides insights for everyday Canadians.

MyMarble just launched pretty recently, are there any other things in the pipeline for Marble Financial or things that you’re looking forward to in the upcoming months?

Continued development of the platform with respect to new features and enhancements. We have new products coming up and new partnerships that we’re working on that we’ll be able to announce. Obviously we’re a public company, so I can’t make these things public nature, but our customers and potential customers can continue to look forward to an enhanced platform, educational content, and products and services that are going to be coming out.

Did you have anything that you’d like to add that we haven’t touched on?

It’s very exciting what we’re doing. During the COVID-19 pandemic, the company has had an opportunity to show its relevance out in the market, and we’re looking forward to doing some great things. [/vc_column_text][vc_separator color=”custom” style=”dotted” border_width=”4″ accent_color=”#1ba2b7″][/vc_column][/vc_row]