[vc_row][vc_column][vc_column_text]Quick Hits (formerly Friday Fix) features all of the things you should know before heading into the weekend.[/vc_column_text][vc_separator border_width=”2″][vc_custom_heading text=”Business” use_theme_fonts=”yes”][vc_column_text]Lessons from the pandemic: How SAMARA managed to more than double their sales during this whirlwind year

As e-commerce continues to dominate the sales front, businesses should shift their focus to ensuring the best customer experience from a digital standpoint. That was one of the biggest lessons of the year for SAMARA’s director of operations, Kira Loftus.

Having joined the SAMARA team two weeks before the pandemic began, Loftus was a key part in helping the online fashion brand hone in on improving up their online experience (which included setting up two new warehouses in North America for quicker shipping times) and building an online community.

The result? Despite this whirlwind of a year, SAMARA successfully grew to $2.5-million in revenue, up from just over $1-million last year.

Like many other companies, SAMARA saw business slow down at the beginning of the pandemic, but they decided to use the time to build out strategies to suit the changing landscape.

“It gave us a chance to do some TLC on the business,” said Loftus. “We looked at how we could serve our customers differently because now it’s a different world.”

The changing trends led to new products that consumers now needed like SAMARA’s anti-planner, which aims to be a prompt for stress relief and comfort during these challenging times, and their bamboo lounge collection, for the ultimate comfort at home.

Loftus acknowledged that no matter how many great products you make, at the end of the day, the postal system plays a large part in the experience of online shopping. Since delivery systems became overwhelmed as online shopping became the new norm, SAMARA set up new warehouses to provide faster delivery service for its customers. While it’s nearly impossible to be as quick as e-commerce giant Amazon, Loftus said that she thinks the pandemic has made consumers more aware of where they spend their money and hopes they are choosing brands they believe in.

“It’s about that connection and that feeling that a company gives you,” said Loftus. “Buying a wallet on Amazon might be more convenient and you might get it the next day. But buying a gift for someone, or a gift for yourself, from a brand that resonates with you and your values, is just as good as next day delivery.”

As Loftus looks towards the new year, she said that a strategy SAMARA will take with it moving forward is the power of pre-ordering. While it was discouraged before the pandemic, she says that pre-orders offered the businesses a chance to continue a steady flow of sales while giving consumers the chance to interact with the site.

“Rather than having something “out of stock,” pre-orders allows consumers to feel active, it helps with production and with sales overall.”

SAMARA specializes in vegan leather goods, created with luxury and minimalism in mind. Since the pandemic, they’ve expanded their range of products, but their goal remains the same: create better fashion, implement more efficient supply chains and use and create more sustainable materials. Read our interview with Salima Visram, Founder of SAMARA, here.[/vc_column_text][vc_custom_heading text=”Food & Drink” use_theme_fonts=”yes”][vc_column_text]

For those who choose to celebrate with alcohol, make sure you have Hydralyte handy. The effervescent electrolyte granules help hydrate up to three times faster than water and have 75 percent less sugar than leading sports drinks. Made with no artificial colours, flavours or sweeteners, simply add Hydralyte to a glass of water to drink before bed and to wake up feeling refreshed and ready to take on the day.[/vc_column_text][vc_custom_heading text=”Need to Know” use_theme_fonts=”yes”][vc_column_text]According to the 2020 Scotiabank Financial Worry poll, millennials and women are worrying more about their finances due to the COVID-19 pandemic.

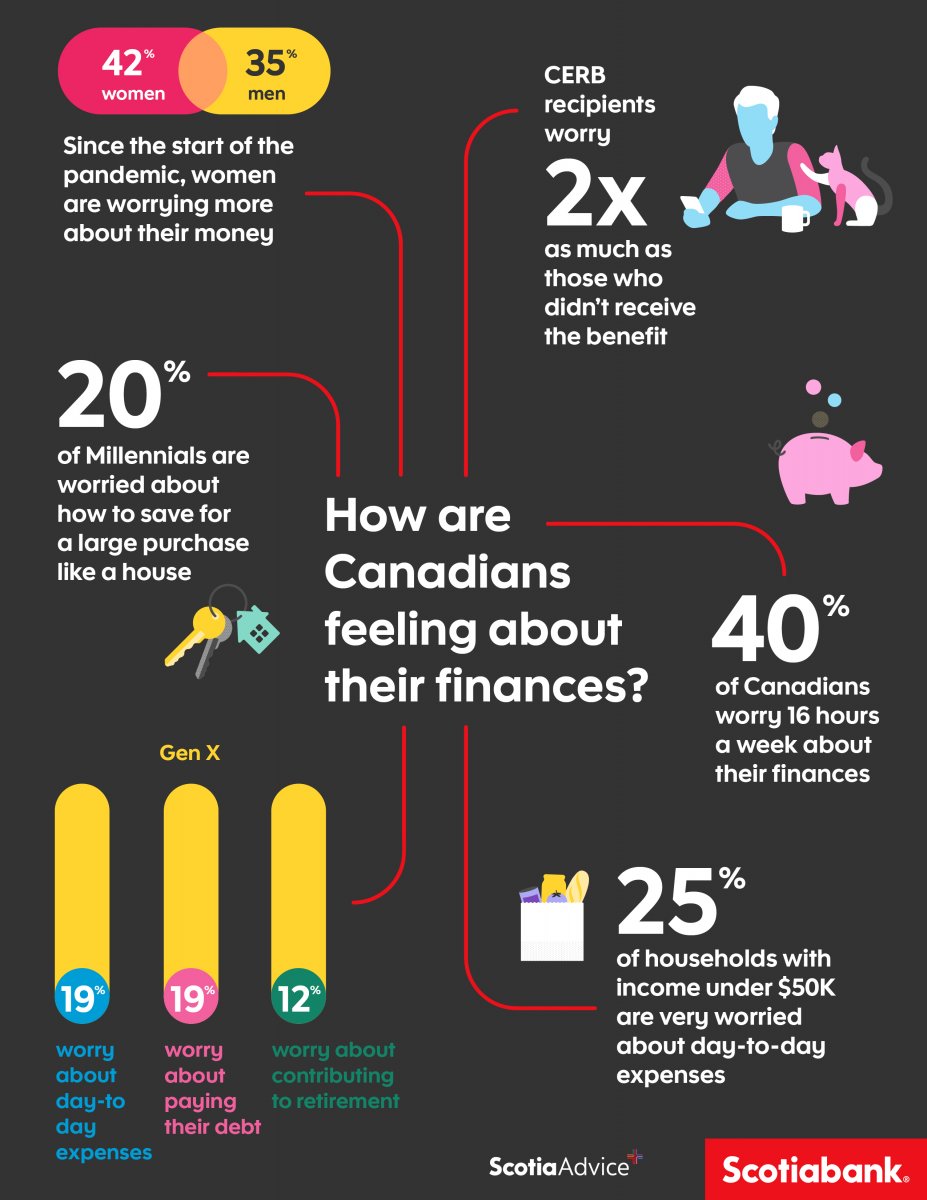

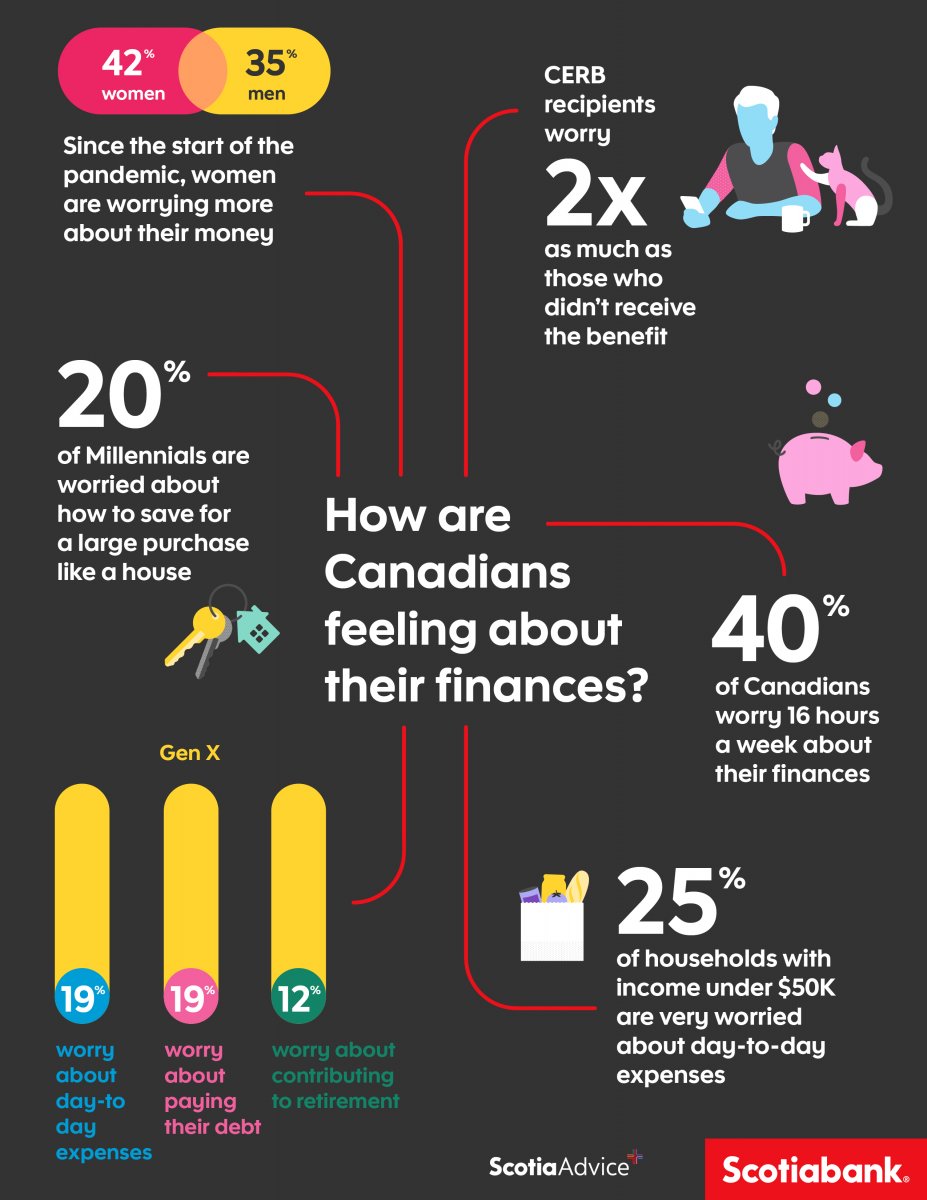

Since the beginning of the pandemic, 42 percent of women (compared to 35 percent of men) have worried about their money. In addition, 45 percent of millennials are more concerned about their finances now than before the pandemic, whereas 64 percent of Canadians aged 55 and over said they are worrying less about their finances—a stark contrast.

Perhaps a reason for the difference is that 24 percent of Canadians aged 18-34 millenials) received the Canada Emergency Response Benefit (CERB) compared to 9 percent of those aged 55 and over; the poll also found that those who received CERB were twice as likely to be worried about their finances.

Now, with tax season approaching, many CERB recipients have the added stress about what will happen with their tax returns and their ability to meet their expenses after paying taxes on the benefits.

To alleviate worry, Scotiabank offers three tips to stay on top of your finances:

- Get financial advice. Having financial peace of mind can help alleviate stress and provide confidence that you have a plan to face whatever challenges lay ahead. An advisor can help build a financial plan that’s tailored to you and that considers your financial goals today and tomorrow.

- Set a budget. Start by looking at your current expenses honestly and adjust accordingly. This will help you plan for your expenses while allowing you to more easily set aside money for an emergency. If you received CERB, remember that the benefit is deemed as taxable income and Canadians will have to pay back the government come the 2021 tax season.

- Stack your emergency fund. The common rule is to save 3-6 months of salary but ask yourself if that’s the right amount and are your savings working for you. If you’re self-employed or a single income household, you may consider saving more. Contributing whatever you can to your fund, even $20 a month, will make a big difference over time. Setting up automatic deposits to your emergency fund will allow you to save without having to worry about it. And better yet, consider putting your savings into accounts that earn you interest and can be redeemed without penalty. It’s always a good idea to check if your employer offers programs that help match your savings as well.

In addition to the tips, Scotiabank recently launched Advice+ which offers customers a range of options to seek financial advice during these trying times.

The 2020 Scotiabank Financial Worry poll was conducted on behalf of Scotiabank by Maru Blue from November 20 – 22, 2020. The online survey captured the opinions of 1,510 Canadians across the country and results of this study are weighted by education, age, gender and region (and in Quebec, language) to match the population, according to 2016 Census data.

[/vc_column_text][vc_separator border_width=”2″][/vc_column][/vc_row]