[vc_row][vc_column][vc_column_text]Though it is a universal act, self-care is subjective. From baking to meditating to online shopping, it comes in many forms. And while each person engages in it differently, one thing that remains consistent is Canadians taking care of themselves mentally, emotionally, and physically during the COVID-19 pandemic.

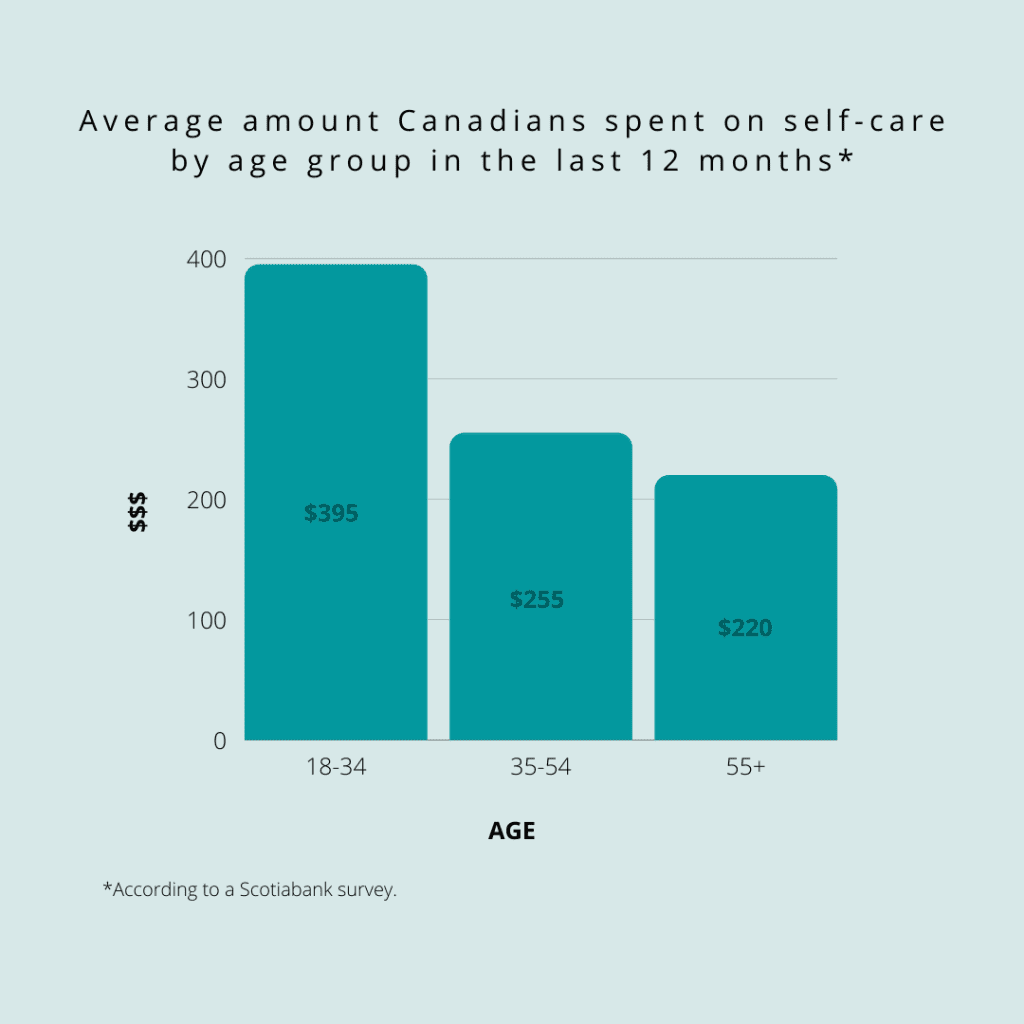

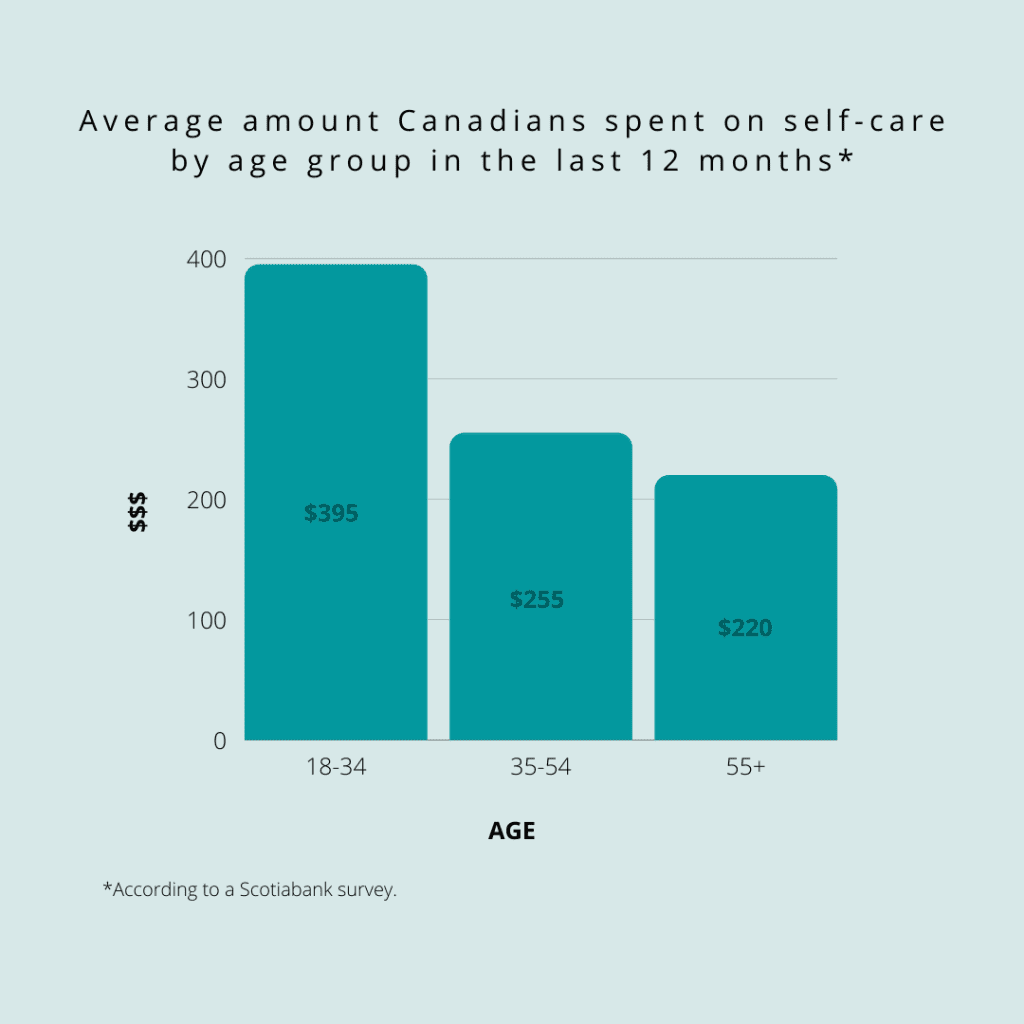

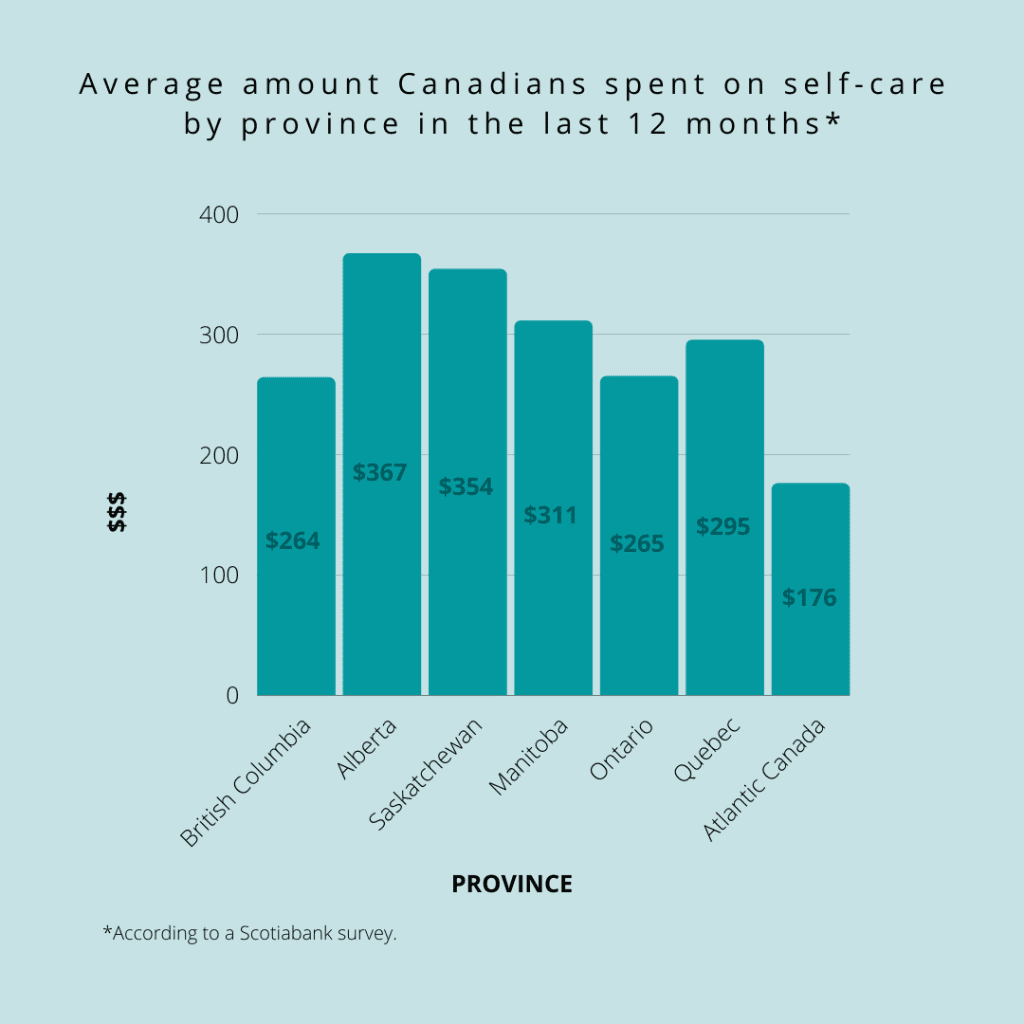

According to a recent Scotiabank survey, 79 percent of Canadians have taken part in at least one self-care activity in the last 12 months, with nearly 60 percent of respondents spending an average of $282 each month.

In addition to making their well-being a priority over the last year, an overwhelming majority (98 percent) said their self-care spending would continue in a post-pandemic world.

Of the activities that Canadians have taken part in to maintain their mental and physical health, baking was the most popular, followed by home workouts and online shopping respectively.

Better budgeting

At first glance, it may seem like Canadians are being frivolous with their spending on self-care, but D’Arcy McDonald, Vice President, Deposits, Investments & Payments at Scotiabank, says that is not necessarily the case. The funds being spent on self-care are most likely finances that have been redistributed from previous spending habits in a pre-COVID-19 world, like filling up gas and buying coffee on the go.

On the contrary, McDonald says that the last year has changed our financial habits for the better.

“I think a lot of Canadians developed some very positive financial management habits through the pandemic,” says McDonald. “Probably a once in a generational shift in terms of adhering to a budget—or at least trying to.”

He adds that the increased emphasis on budgeting is most likely due to the fear and uncertainty during the beginning of the pandemic, but believes that the new budgeting habits are here to stay even once the world returns to normal; whatever “normal” is.

To spend or not to spend

“Who would’ve thought that you would need emergency savings to get you through a year,” says McDonald. “The best advice would have been for three to six months and that certainly wouldn’t have cut it in this instance.”

Given the volatile state of the world, the most important thing is to continue to build better financial habits. Luckily, 68 percent of Canadians, said they feel good about their financial health over the last year. For the 32 percent who rated their financial health as fair or poor, McDonald says that financial advisors are always ready to help.

Whether you believe that online shopping is a form of therapy, find comfort in the kitchen, or can’t live without your online workout class, self-care spending seems to be a part of all our lives that’s here to stay. So, go ahead and confirm your online order —as long as it’s within your budget.[/vc_column_text][vc_separator][/vc_column][/vc_row]

[yikes-mailchimp form=”1″ title=”1″ submit=”SUBSCRIBE”]