[vc_row][vc_column][vc_column_text]The pandemic has been gruelling for small business owners, lasting much longer than many of us initially anticipated. A large swath of small businesses have been supported and survived strictly based on the extensive financial aid offered by the Canadian government. But while these programs have been essential for many and generally well-received, they’ve been confusing for a large group of business owners, and accepting their benefit comes with added oversight in the form of audits that few understand.

One of the most prominent financial aids offered to Canadian businesses is the 75% Canadian Emergency Wage Subsidy (CEWS). As of October 1st, the GoC has recorded roughly 1.2 million in approved applications and $40 billion in subsidies paid from the Canadian Emergency Wage Subsidy alone. Though incredibly useful, from Humi’s experience supporting Canadian SMBs throughout the pandemic, we observed that most business owners had faced various difficulties utilizing the CEWS.

Initially, the most common concerns were derived from the subsidy’s eligibility criteria. Public consultations conducted by the Department of Finance prior to the CEWS’ expansion produced results that would largely corroborate with our observations as well, as noted in the July announcement to expand the CEWS program.

The expansion of CEWS greatly enhanced the program’s coverage, but introduced a different class of concerns. According to our customers, primary challenges are now associated with confusion around the new alternative mechanisms for determining eligibility and subsidy amounts.

Knowledge Bureau, a Canadian financial education institute, found that the majority of the surveyed financial professionals believe the CEWS program mechanics are too complicated, albeit fair. As such, it is important to understand how the eligibility requirements and the mechanics of CEWS have evolved over time.

Here’s a breakdown of the CEWS and its important characteristics[/vc_column_text][vc_single_image image=”20117″ img_size=”full” onclick=”img_link_large” img_link_target=”_blank”][vc_column_text]

You can learn more about the CEWS on the CRA’s website here.

[/vc_column_text][vc_column_text]In addition to understanding the eligibility and calculation requirements, business owners should also understand the implications around CRA audits, as businesses that are deemed non-compliant may have to repay any ineligible amounts, interest, and penalties.

In September, the CRA began auditing companies that have made CEWS claims, and will gradually expand its audit process. Because of the quarantine measures, the audit process will be conducted virtually. For the majority of information requests, business owners are required to adhere to a turnaround time of no more than ten business days.

Given the expectation of a speedy turnaround in the case of an audit, it is highly recommended you keep the following items handy:

- Documents from your minute books (or corporate records), such as any excerpts of governance documents included in the minute book as they relate to the CEWS claim.

- Revenue numbers for the 2019 taxation year (e.g. general ledgers and revenue journal entries).

- Revenue numbers for the 2020 taxation year (e.g. general ledgers and revenue journal entries).

- Revenue information that illustrates the CEWS revenue decline percentages for each reference period.

- General payroll information, such as source deductions, employment contracts, bank statements, and proof of payments.

- Information relating to other subsidies and other government programs that impact the CEWS claim, such as 10% Temporary Wage Subsidy.

- A signed copy of your CEWS Attestation Form (RC661).

- Supporting documents for exceptions or elections utilized for CEWS (see Q6-4 and Q8-3 for definitions).

- A list of exclusions of remuneration, such as a list of any employees who were not receiving eligible remuneration for 14 or more days in a qualifying period.

- A list of exclusions of qualifying revenue from sources such as extraordinary items or other subsidies claimed

While survival is justifiably at the forefront of every business owner’s thoughts right now, putting in the extra effort to maintain good records is essential, particularly if you’ve benefited from the CEWS. Although the government won’t have the capacity to audit every business, the expectation is that these audits will be widespread. [/vc_column_text][vc_separator style=”dashed” border_width=”2″][vc_column_text]

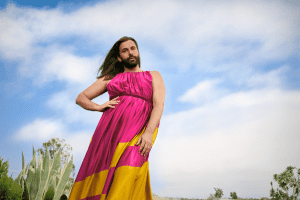

Simon Bourgeois is the Co-CEO and Co-founder of Humi, a leading HR, payroll and benefits service. Read Bay Street Bull’s interview with Simon here.

[/vc_column_text][/vc_column][/vc_row]