[vc_row][vc_column][vc_column_text]The COVID-19 pandemic completely disrupted old limits and restrictions on what’s considered a work environment. Much of the workforce began working from home and yet the world still turned.

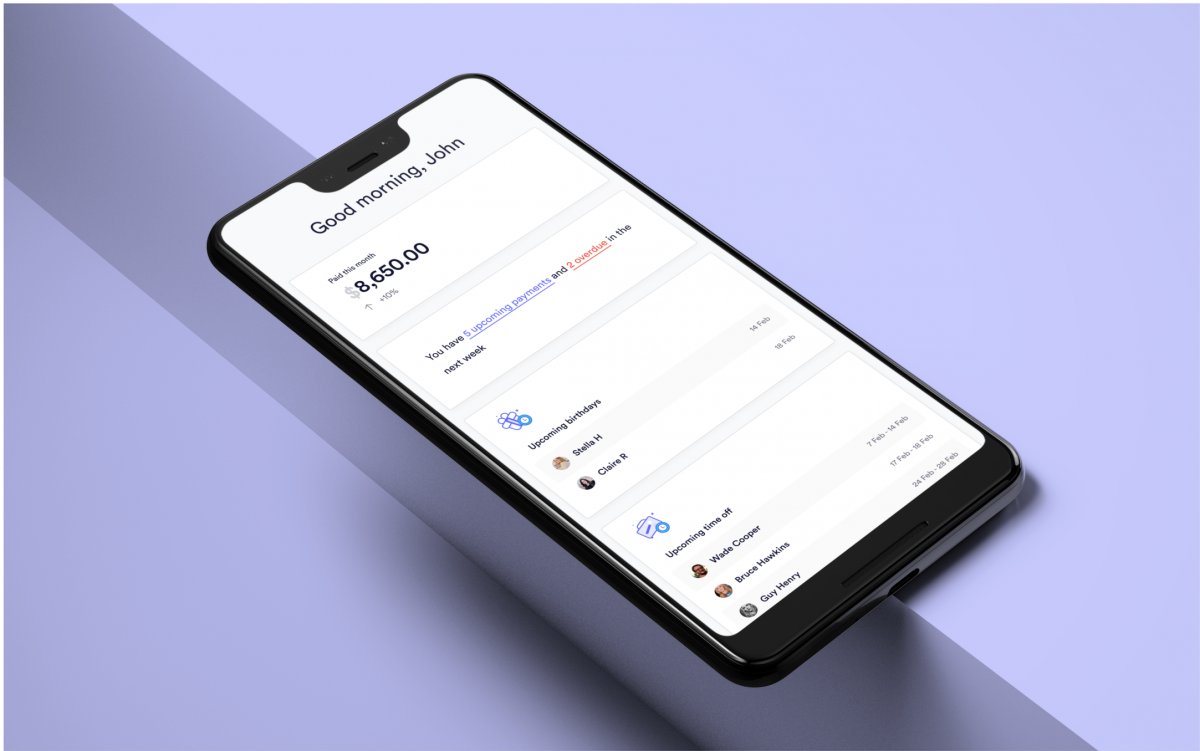

Given the new way of the world—and the now widely accepted truth that you can work from home and still be productive—the illusion of geographic restrictions on a talent pool is shattered. At the forefront of this change is global payroll and compliance platform Deel.

Based in San Francisco and recently launched in Canada, Deel makes it easy to hire and pay employees from around the world. Pre-COVID-19, many job opportunities depended on your location (or whether you were willing to move) but now, they seem relatively unlimited. As long as you can get online, you can get to work.

The financial technology (FinTech) company is the brainchild of co-founders, Alex Bouaziz and Shuo Wang. Deel helps companies and independent contractors in both the hiring and payment processes, to ensure a smooth experience despite geographic barriers.

“I just think that people should hire anywhere that they want to, and if employees want to travel or work from anywhere else, they should be able to,” said Wang.

Since the pandemic began, many companies seem to agree. Despite 2020 being a whirlwind of a year, Deel managed to increase revenue by 20X. And they’re not slowing down anytime soon.

By coming to the Great White North, Deel now supports over 120 currencies—the Canadian dollar being the latest. Wang said she’s excited to expand into Canada. Despite living in Los Angeles, which has three of its own NBA teams, she’s a huge Toronto Raptors fan.

As geographic limitations continue to become a thing of the past, Deel is set to being at the forefront of increasing hiring capabilities and opportunities. For this week’s Startup Spotlight, Bay Street Bull spoke with Shuo Wang, Co-Founder and CRO of Deel, about changing the hiring landscape, disrupting traditional payment methods, and entering the Canadian market.[/vc_column_text][vc_text_separator title=”Q&A” color=”custom” style=”double” border_width=”3″ accent_color=”#1d3f93″][vc_column_text]Why was Deel created?

I’ve always believed in hiring remotely and internationally because I firmly believe that talent is located globally—we should not hire only in one spot. With the development of all kinds of technology, people have more access to external information and they’re not locked to one region. In the past, information was not transparent; one country didn’t know what was happening in another country, right? So, I just think that people should hire anywhere that they want to, and if employees want to travel or work from anywhere else, they should be able to.

I’m also a huge fan of FinTech and I’ve always wanted to build a FinTech product myself. So just by doing some basic research, I came up with this idea to build a payment platform for independent contractors or international teams. With Deel, people can get paid very easily, with no delay, and no compliance issues. Also, the transaction costs are minimized for the people who are getting paid internationally.

Why was it important for you to create something that was not only just for both companies and contractors?

We saw the trend. At the very beginning, Deel was only a payment platform for independent, international contractors, so that they could get paid easily. After we chatted with many of our clients, we saw the problems in between; they had problems dealing with compliance, setting up employment contracts, and picking the best payment method. Also, transferring money and setting up payments were becoming more and more complicated. By chatting with our clients, we understood their problems, so we could build the products to solve them.

Were there any challenges in bringing Deel to life?

Number one was and is trust. As a young startup, we’re competing with all kinds of big platforms, like TransferWise, JP Morgan, local banks, and partners. So, how do we introduce Deel’s unique position versus a traditional bank, or international wire transfer, or PayPal? Instead of competing with all of those payment providers, we’re actually integrating them on one system, in one platform.

On Deel, if all of our independent contractors or international employees want to get paid through different payment methods on different bank accounts, we’re able to do that. We support different payment methods from PayPal to crypto. For clients, they pick one day each month as their payday to run payroll. They could pay 100 people or 50 people or 10 people on Deel, it doesn’t matter. They just choose one day of each month to run payroll and then they send payments to Deel. After we receive the payment, we send the payments to their international teammates.

One thing you mentioned was your belief in the practice of hiring remotely and being able to explore the global talent fields. Can you just expand on the business benefits of being able to hire outside of the country?

Right now, I’m in San Francisco, and when you hire out of San Francisco the salary is really high. A data scientist here would be paid three times more than what I could get in the United Kingdom or Poland or Ukraine, even though their level and their skills are the same. There’s no clear difference between the talents in San Francisco and then the talents in Europe or Asia. Being able to hire internationally, gives the employers and then also the clients more opportunities to explore talents in a more reasonable salary range.

Second, teammates can work wherever they are at. Right now, I’m in San Francisco, but my co-workers might be in Montana or maybe Hawaii or some of them could be in Indonesia. With Deel, employees can travel and work from wherever they want [aslong as their company supports remote work].

Obviously, with the pandemic, most people and companies aren’t at the office. Did Deel see an increase in users during this time due to the uptick in working remotely?

I think the pandemic definitely accelerated the concept of working remotely. At the very beginning, people were at home instead of working in a centralized office. Big companies, at the very beginning of the pandemic, were not open to having a remote team. But now, after a year, they see the transition, and that business is still the same. Maybe they can support a fully distributed team then? Right.

For Deel, we’ve been a fully distributed company since day one. As I said, we had those trust issues because we’re only a startup. How were companies supposed to trust to give us their money so that we can do the transactions? We built that trust a few ways: 1) by having our headquarters in San Francisco 2) we are a Y Combinator-backed company 3) I would stand here and show them that I have a corner office to show them that we’re a legit company, but this is really just a corner of my home [laughs].

Now, I don’t need to do all of that. I just need to tell them that, “Hey, Deel is a remote company itself.” We use our own system to run payroll right now and we have 100 teammates across 25 countries. So that automatically makes potential clients trust us more.

What kind of response have you had from the companies and clients that are using Deel?

In the beginning, they’re a little bit hesitant, “How do I hire the best of talents? How do I trust them?” They will try one or two hires on Deel to start, and we don’t only send payments, but we can also help with background checks. So, we collect the necessary documents and the paperwork, to make sure that the talent and the company’s workloads are legit, so there is no misclassification risk or problems when sending payments to the international teammates. That’s what we do. After trying it, six or seven months later, they’re fully okay with hiring remotely or hiring internationally. We’re always building this trust between Deel and the client.

Have you seen more companies reach out to you to use you given the change of the world? What has your growth been like?

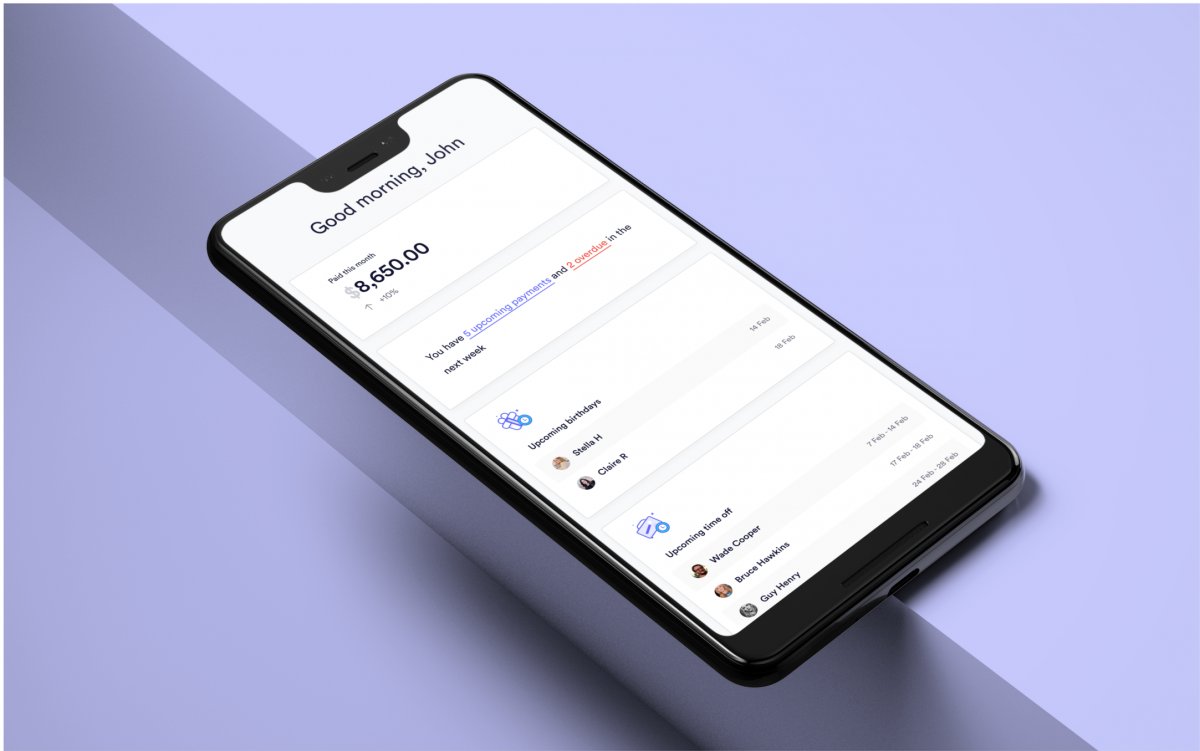

We have been growing very fast during the pandemic. Our revenue last year was 20x, and our team grew 10x. We also went through two rounds of funding last year, closing our Series A in May and our Series B in August.

Last year, we didn’t support full-time employees. Now we do so that companies can use Deel to hire across 40 different countries. We’re constantly opening new entities and they support new countries so that our clients or our companies can use us to hire full-time employees. Right now, for independent contractors, we support 150+ countries.

That’s very exciting! What are your hopes for the future of Deel? You’ve said that the company moves very fast, so where do you hope to see it in five, 10 years?

I think I want to make Deel a lifestyle company. I know it’s weird to say that [laughs], “You’re a B2B SaaS, in FinTech, How can you be a lifestyle company?”

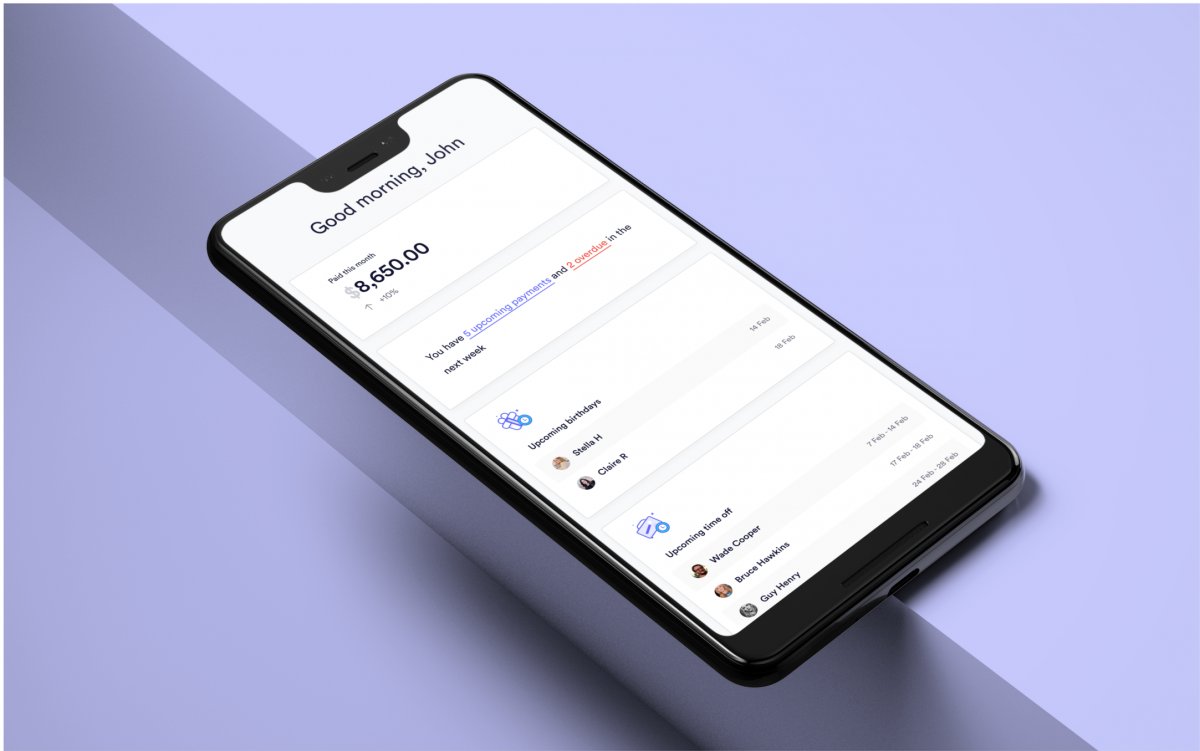

Employers are starting to see that they can hire talent overseas, but another thing that we see that is the talent doesn’t have the same benefits and those based in the country where the company is hiring from. So, we want to be able to provide benefits directly on Deel. For example, pensions, housing insurance, or equity and stock options. Then, Deel will provide international teammates with everything that they need to not only get paid but also get to their pension, their equity, their insurance, etc.

What kind of company is Deel useful for? Is there a certain size?

We support all segments. We have SMBs, we have mid-market, and we also have public companies that are using Deel right now. For companies from different segments, they have different requirements and different needs. We build customized features for all of those companies. For example, for enterprise, they probably want a customize the domain and we’ll be able to support that. SMBs tend to have more flexibility when hiring internationally, but for enterprise, we’ll have to follow certain procedures like legal and compliance checks and setups. We have a full team of customer success managers to be able to support all kinds of client needs.

Why should someone use Deel versus the traditional banking methods or wire transfer?

We move very fast. And we are human beings, not robots. One of the things that we did really well on was our customer support team. We have 24/7 customer support and we are really proud of them. Sometimes international payments are complicated. If you use traditional bank transfers it could take like three, five, sometimes 10 days for sending payments to Russia, for example. With Deel, we’ll be able to have the Russian teammate received their funds within two business days. And sometimes those Russian teammates need paperwork filled out, and whenever they need anything, they can just reach out to our customer support team. We’ll be able to gather the documents and if they need help to withdraw their funds from their bank.

Our customer support team covers all time zones 24/7. We also cover 10 languages. Another thing that we do is provide a good entrance rate as well. Traditional banks and payment platforms tend to charge a really high percentage, but we will always pick the most optimized rate and make sure that whoever is getting paid on Deel can get the most out of their payments.

Also, we’re trying to do something innovative. We don’t charge a setup fee. It is a pure SaaS model, month over month. Traditionally these things are complicated, so we’re trying to simplify them. We digitize everything so that there are no manual inputs or uploads on spreadsheets anymore.

Deel recently launched here in Canada. What are you looking forward to with expanding into Canada?

Canada is one of the most popular countries for American companies hiring outside of the United States. We speak the same language, the culture is similar, we’re so close. It may be hard for companies to set up up an entity in Canada, but hiring talents from Canada is relatively easy. We figure if we help them solve the compliance issues and we provide the same benefits to Canadian employees, similar to their American employees, everyone’s happy. [/vc_column_text][vc_separator color=”custom” accent_color=”#1d3f93″][/vc_column][/vc_row]

[yikes-mailchimp form=”1″ title=”1″ submit=”SUBSCRIBE”]