Culture Counsel is a monthly column focusing on the intricacies of law through the lens of pop culture and business.

Below we provide a summary of the Canadian government’s policy to help Canadians and Canadian businesses during Coronavirus. We also encourage you to go to the Prime Minster’s website for his direct policy statement.

This is a long list. At the end, I also include a summary of what the banks are doing and strongly encourage you to also read that section.

As we understand the impact of COVID-19 on Canada, it is quite possible that the timelines originally stated by the government may change, as well as the programs themselves. In addition, the eligibility requirements to some of the programs noted below are also being determined, which may impact the availability of the programs to your specific situation.

Understanding the COVID-19 Emergency Response Act

This legislation enables the government to make temporary changes to already established legislation (i.e. the Income Tax Act) and also creates two new legislation, which I summarize below:

Canada Emergency Response Benefit Act (“CERBA”)

- This is a temporary piece of legislation that provides new economic support programs that are specific to COVID-19.

- It provides income support from between March 15, 2020 and October 3, 2020.

Public Health Events of National Concern Payments Act

- This is a new piece of legislation that enables the government to act immediately should a future global pandemic happen.

- It enables the government to acquire medical supplies, provide assistance to provinces and territories, provide income support and to fund public health-related programs.

A Summary of the Federal Government’s $82 Billion Economic Response Plan

- $52 billion will be set aside for direct support for Canadian workers and businesses;

- $55 billion will be used to facilitate tax deferrals. This enables Canadians to keep money in their pockets during this time.

- The CERBA program will not be available until early April and it is foreseeable that there may be additional regulations and/or eligibility requirements.

- On multiple occasions, Trudeau has stated that this has been created on a trust system and those individuals or businesses that take advantage of the program will be penalized.

Business

- $10 billion investment to increase credit available for small, medium and large businesses, which is available through BDC and EDC.

- The scope of EDC, which currently is to support Canadian businesses exporting internationally, will be expanded to also provide support to domestic businesses.

- The Canada Emergency Business Account will provide interest free loans of up to $40,000 to small businesses and not for profit organizations to help with operating costs. In order to be eligible, they must pay between $50,000 and $1,000,000 in total payroll for 2019.

- The government also has the ability to provide additional support to Canadian businesses where additional support would be in the national interest to deal with exceptional circumstances. It is possible that this is code for a tourism, hospitality or airline industry bail out.

- $50 billion investment into the Canada Mortgage and Housing Corporation to stabilize Canada’s housing market.

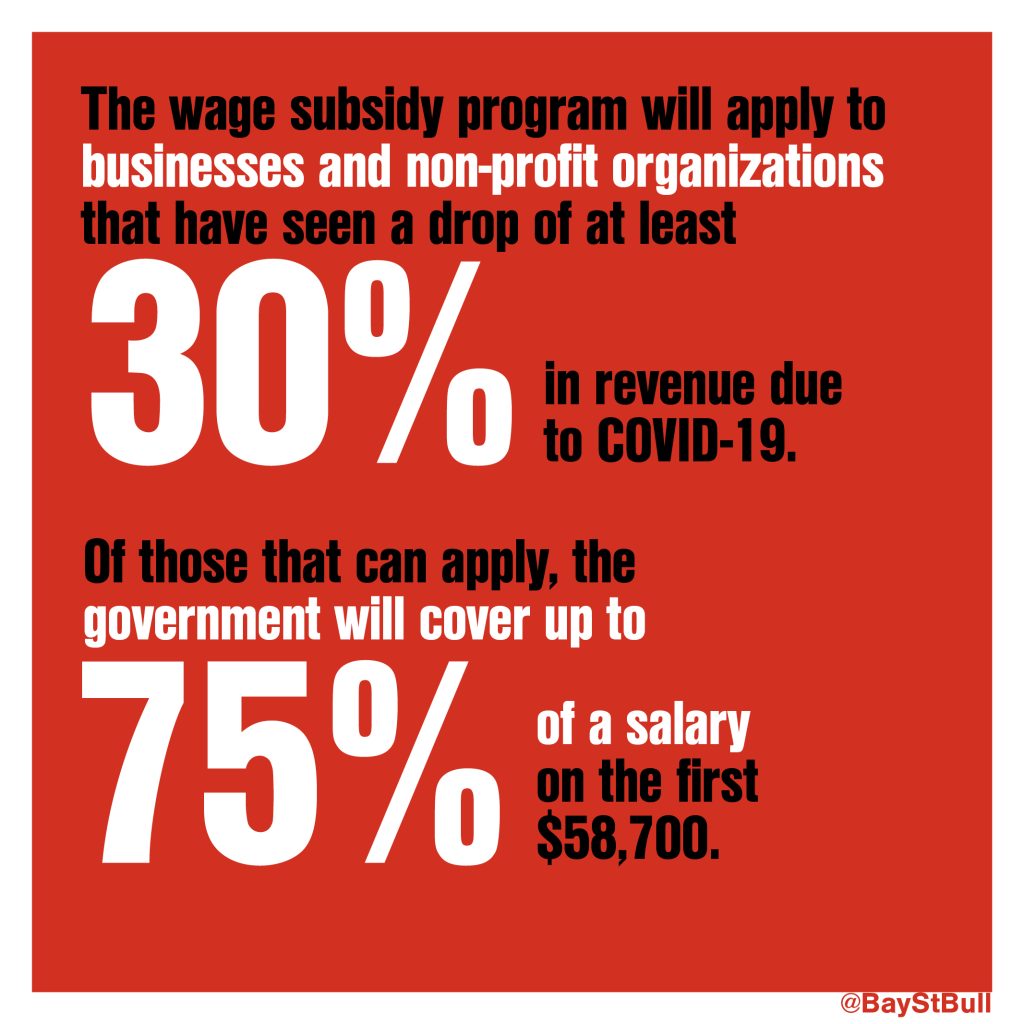

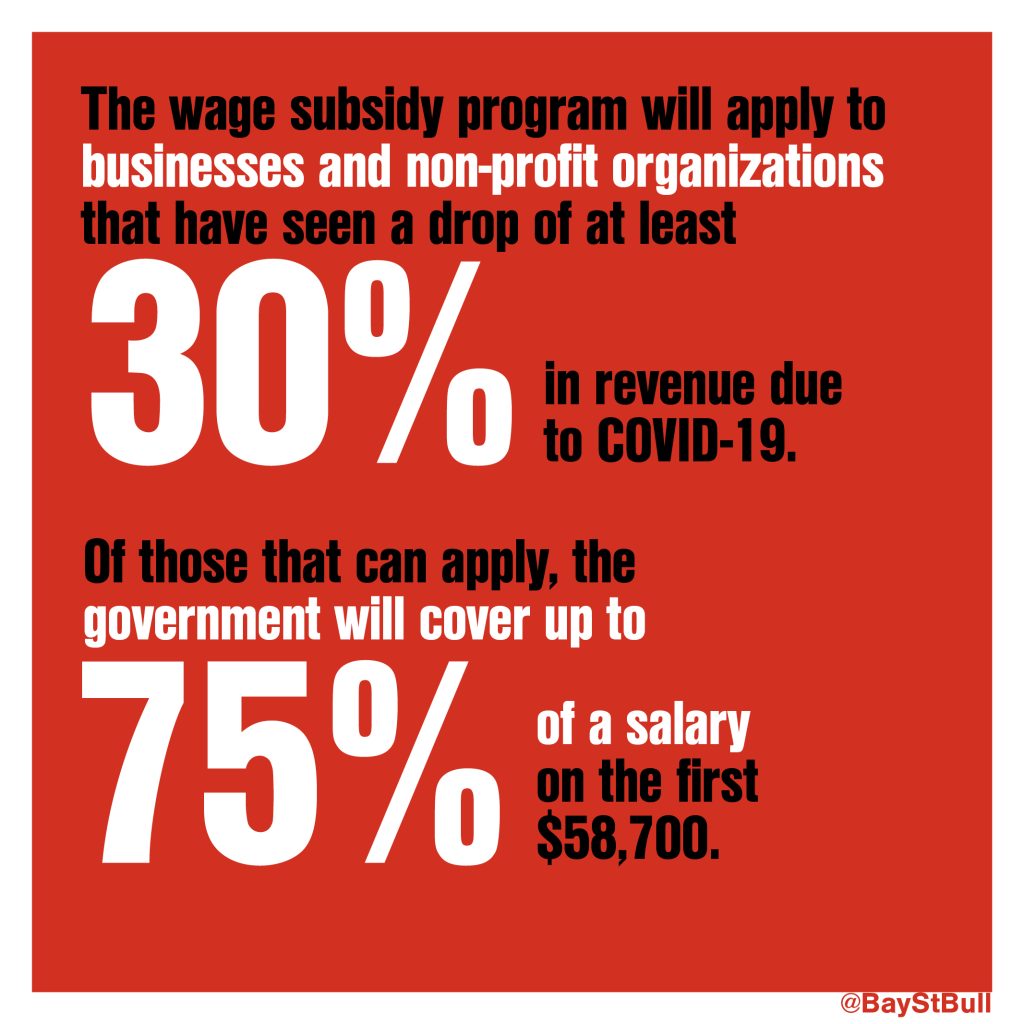

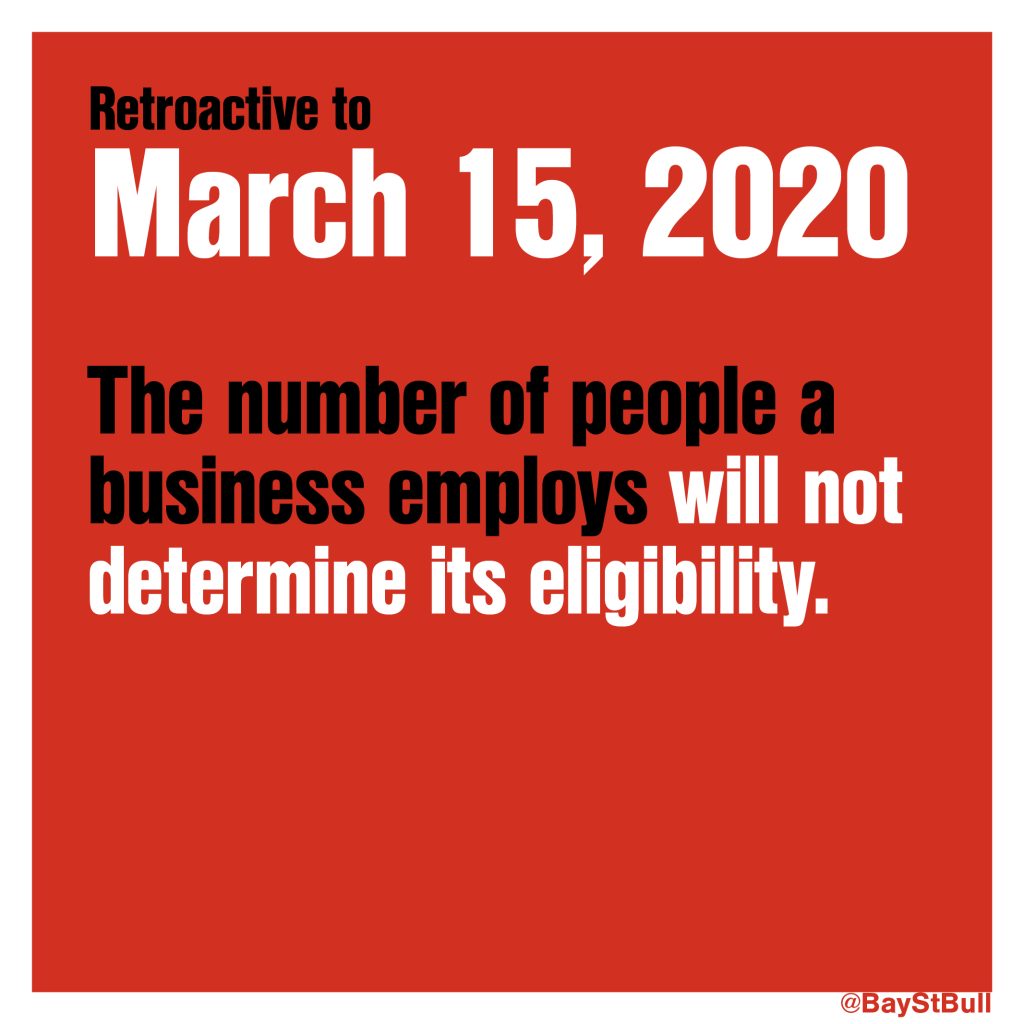

Retroactive to March 15, 2020, the government is providing a 75 percent wage subsidy of a salary on the first $58,700 to qualifying businesses for up to three months. Businesses that have experienced a 30 percent decrease in revenue due to COVID-19 are eligible and the number of people a business employs will not determine its eligibility. Trudeau was strong in his messaging that there is an expectation on businesses to do more than less to keep their employees and to also use best efforts to top up the remaining 25 percent wage.

Contract Workers and Self-Employed

- Up to $10 billion for income support for workers, which includes $2,000 per month (capped at 16 weeks) to workers who do not have access to paid sick leave or EI benefits, who must stay at home because of either (a) self isolation/quarantine and/or (b) taking care of dependents/elderly who are sick.

- Up to $5 billion for Emergency Support Benefit, delivered through the CRA, to support workers who are not eligible for EI benefits and who are facing unemployment.

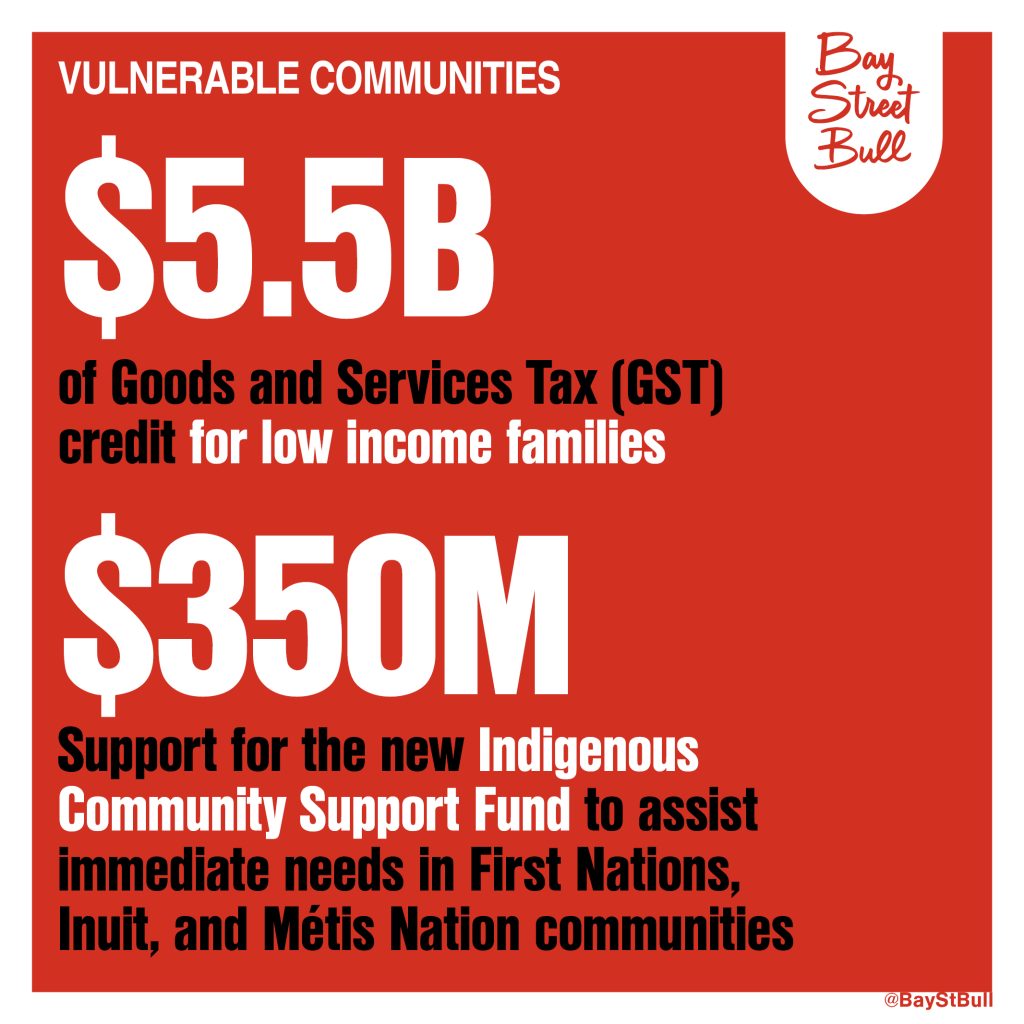

- Additional assistance for low to modest incomes for a top up through their GST credit. (There is some vagueness in how they describe this and so I am uncertain as to the specific amount set aside.)

- Waive the 1 week waiting period for those who qualify for EI to have access. This is currently only applicable for the next 6 months.

- Waive the requirement for a medical certificate to qualify for EI sickness benefits.

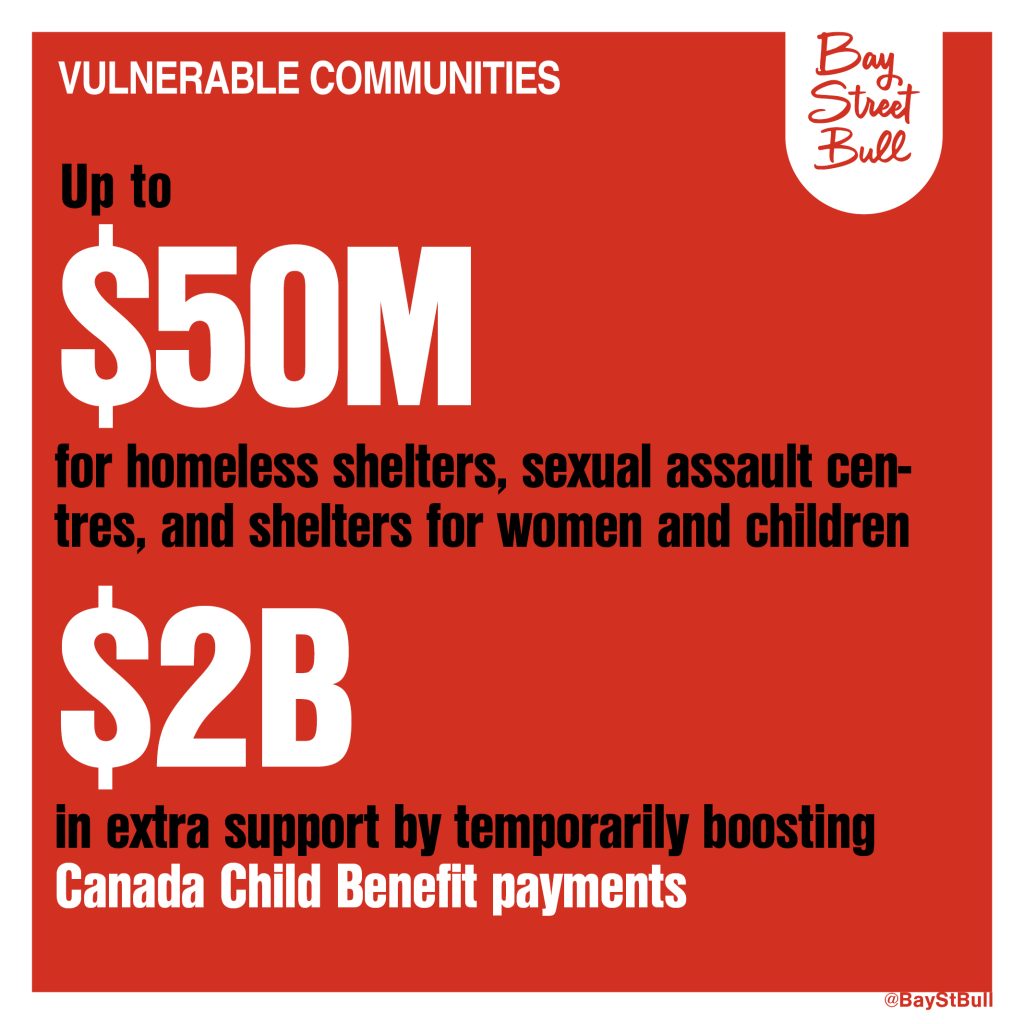

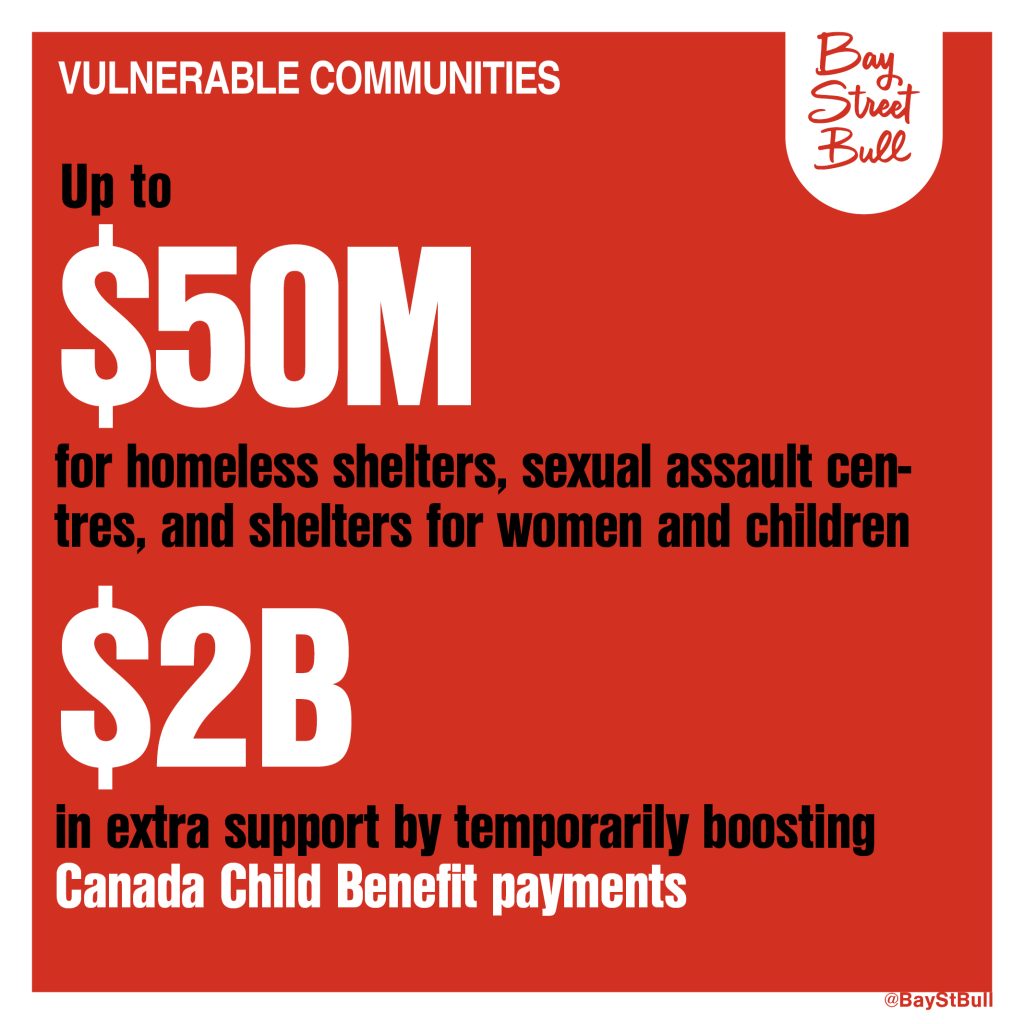

- $2 billion boost into Canada Child Benefit payments to assist families with children.

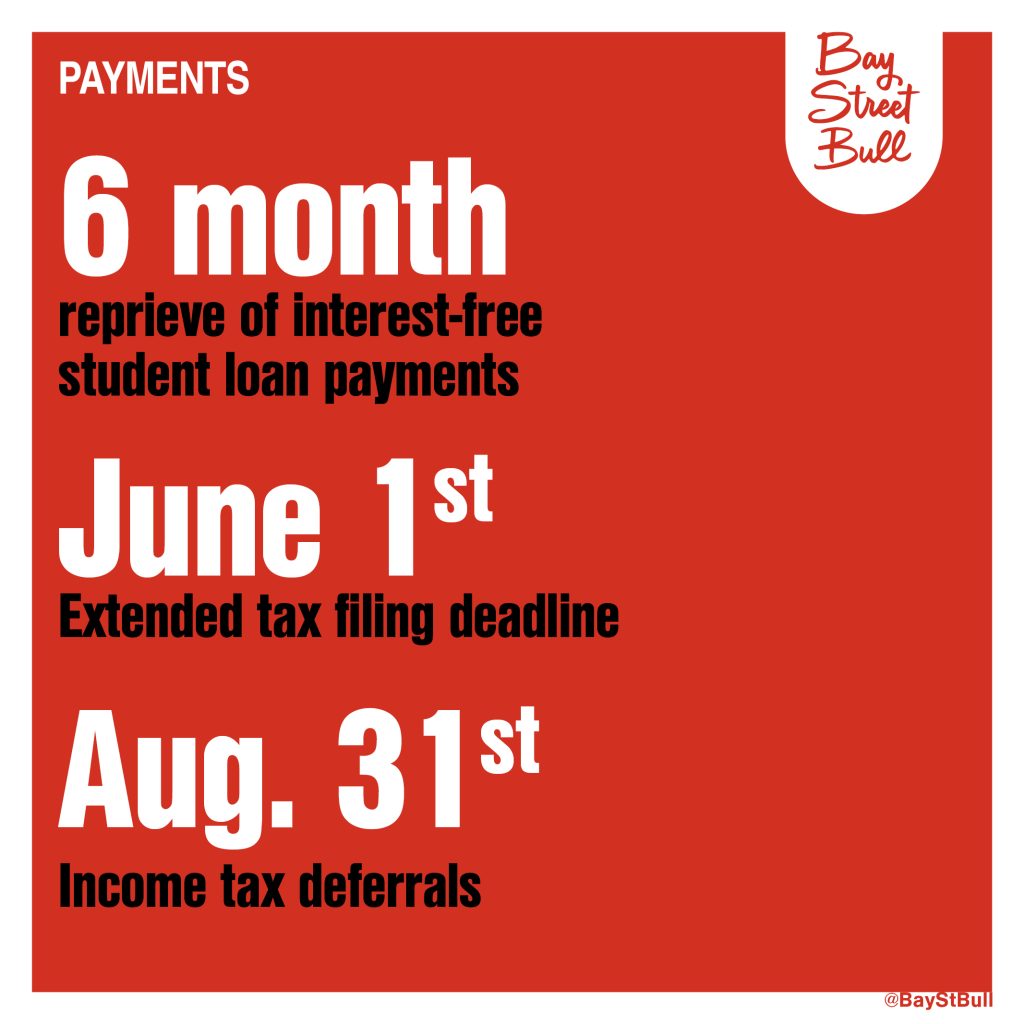

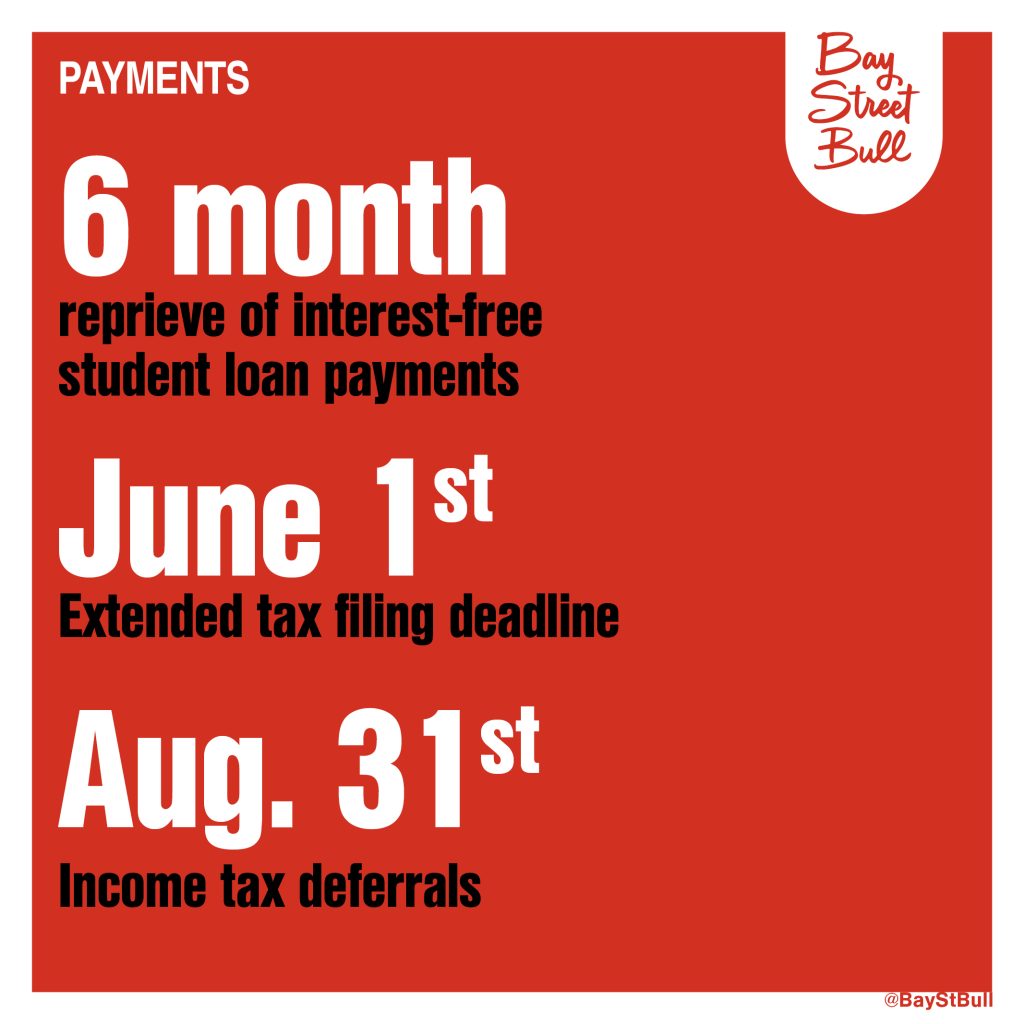

- Deferring personal tax payments until August 31, 2020. The tax filing deadline has been extended to June 1, 2020. There will be no late payment penalties during this time period. Again, this enables Canadians to have more money in their pocket. But, recognize that this is a deferral in payment. You will have to pay your taxes. Be careful and strategic as to how you spend this money as it will be money owed.

- Deferring corporate tax payments to after August 31, 2020. There will be no late payment penalties during this time period. This enables Canadian businesses to have more money in their pocket. But, recognize that this is a deferral in payment. You will have to pay your taxes. Be careful and strategic as to how you spend this money as it will be money owed.

- Payment of HST and custom duties for imported products is deferred until June 30, 2020.

- The Government is also contemplating the social justice issues that may be exacerbated during this time:

- Protecting Registered Retirement Income Funds to protect seniors’ investments;

- 6 month hold on paying back Canada Student Loan payments;

- A fund set aside for Indigenous communities;

- Funds support for women and children fleeing abusive home lives;

- Funds to support homeless shelters.

A Summary of the Canadian Banks Support of the Economic Stimulus Package

The Canadian banks have also been working together to help Canadians and Canadian businesses. Yesterday, Canada’s six largest banks (BMO, CIBC, RBC, NBC, Scotia and TD) have agreed to do their part to help personal and small businesses. This will be done on a case by case basis. This support includes up to a six month deferral on mortgage payments, as well as other relief on debt payments. As of right now, this is very much of a case by case situation and I was not able to get more concrete details. However, I recommend that you contact your bank directly to see what can be done about your mortgage payments and loan payment plans.