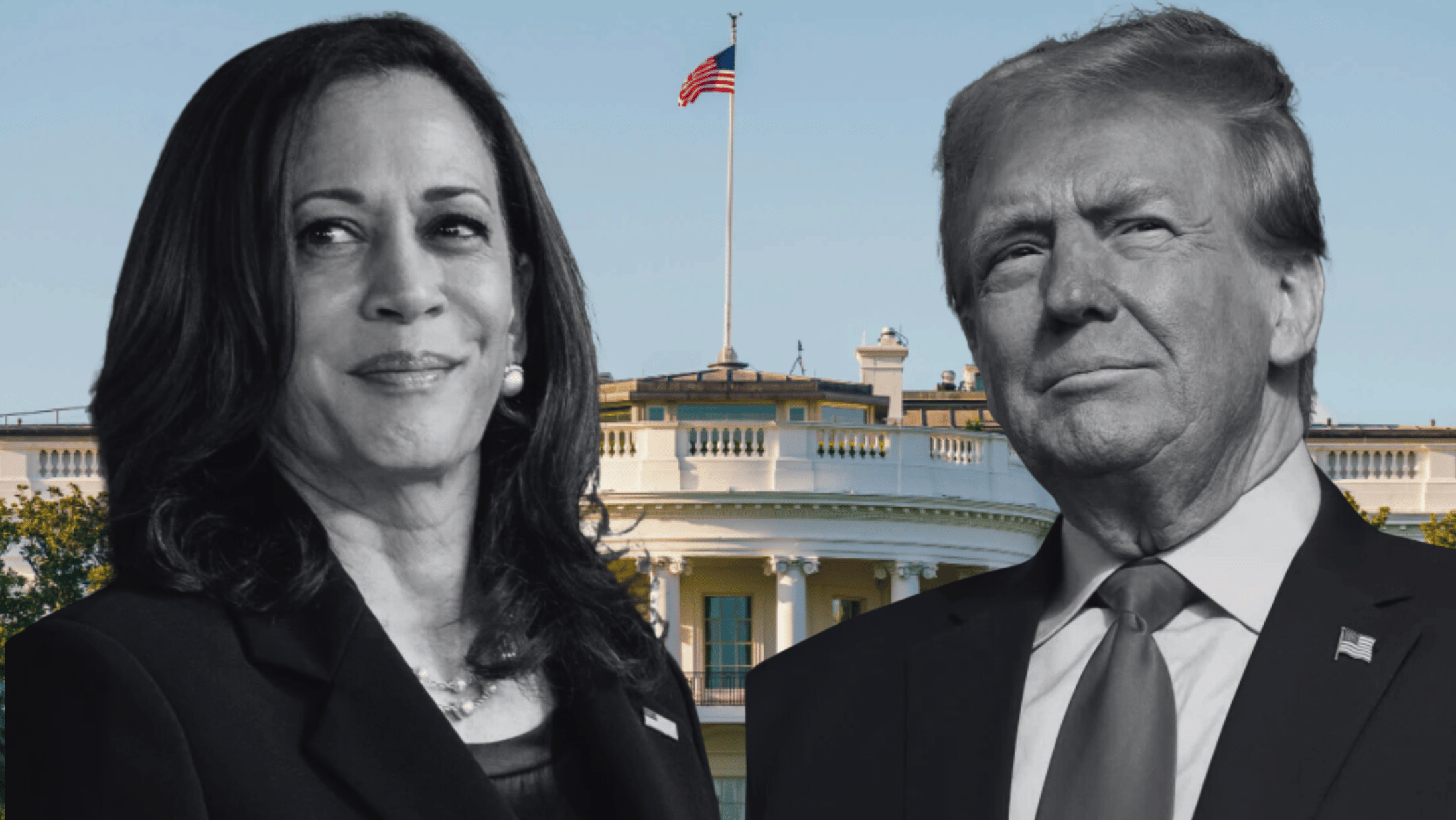

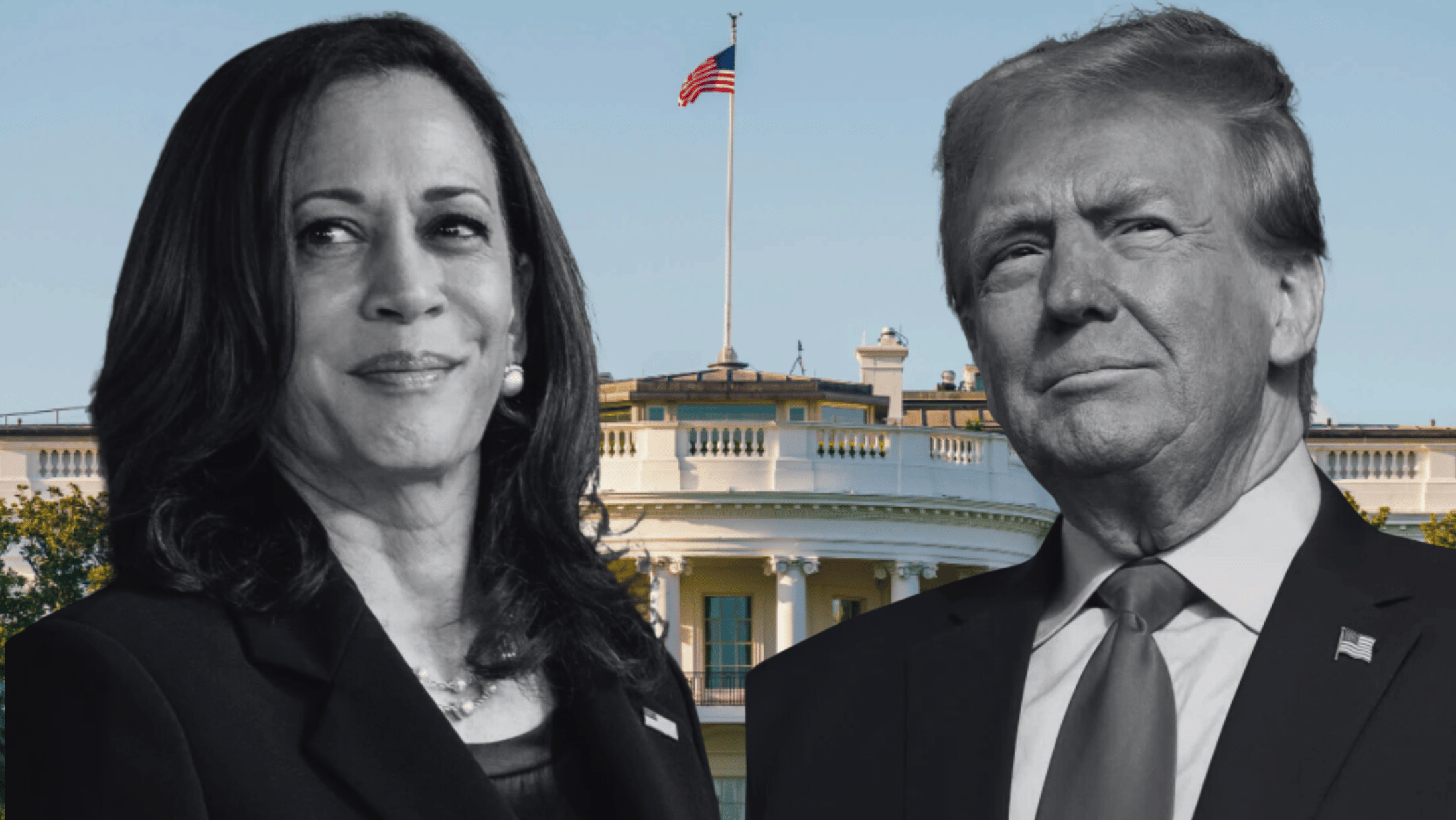

As the U.S. election approaches, Canadians should pay close attention to how the political landscape south of the border could shape our economic environment. The candidates’ differing visions could lead to significant shifts in trade policies, corporate profits, and market stability.

Democratic candidate Kamala Harris is championing domestic competitiveness, particularly in sectors like renewable energy, semiconductors, and infrastructure. Her commitment to maintaining current trade policies could foster a climate of stability, which might translate into steadier corporate profits for Canadian businesses that rely on trade with the U.S. However, discussions around a potentially weaker U.S. dollar under her administration raise concerns. A depreciation of the dollar could lead to short-term inflationary pressures, impacting Canadian consumers and businesses alike.

Conversely, Republican candidate Donald Trump is advocating for sweeping tax cuts, particularly for corporations. This approach could provide a significant boost to profits in industries like oil, gas, and banking, potentially benefiting Canadian counterparts in those sectors. However, Trump’s willingness to impose higher tariffs—such as a proposed 60% on Chinese imports and up to 20% on others—could disrupt trade relationships and lead to increased costs for Canadian exporters.

A recent report from TD Economics points out a historical trend: when Democrats take office, the stock market often performs better. This is likely tied to the economic conditions at the time rather than party affiliation alone. Still, it suggests that investor sentiment could shift based on the election outcome.

With market volatility a common occurrence in election years, the stakes are high. Regardless of which candidate prevails, the effects will ripple through Canadian markets, affecting everything from currency stability to trade agreements. As we navigate this uncertain terrain, staying informed will be key to understanding the potential impacts on our economy.